missoula property tax increase

Louis County Missouri is 2238 per year for a home worth the median value of 179300. The median property tax in Montgomery County Pennsylvania is 3834 per year for a home worth the median value of 297200.

Fire Magic Echelon E790i Built In Grill With Digital Thermometer Outdoor Kitchen Appliances Built In Grill Natural Gas Grill

The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300.

. - Solid investigative work over several weeks led Missoula County Sheriffs Office Detectives to recover more than 200000 in stolen property. Notice to Montana Employers and Interested Parties Pursuant to 39-3-409 MCA Montanas Minimum Wage will increase to 920 effective January 1 2022. An established build site and developed pond increase equity.

See what hurts property value from your homes condition to improvements done wrong and tips to increase your property value. An August 3 incident in the 9000 block of Tucker Lane where a homeowner on vacation reported seeing two males accessing their home via a security camera resulted in the arrest of the. The Homestead Acts were several laws in the United States by which an applicant could acquire ownership of government land or the public domain typically called a homesteadIn all more than 160 million acres 650 thousand km 2.

4065234752 Missoula County Website County Clerk has birth and death from 1895 and land records. The tax increase comes on the heels of an almost 12 tax increase put in place by the city earlier this week. HomeLight Blog 424 287-1587 Call us.

Missoula County Public Schools take the largest share at 316 while. Montgomery County has one of the highest median property taxes in the United States and is ranked 76th of the 3143 counties in order of. The highway is the main transportation corridor between Missoula and Ravalli counties both of which respectively experienced 79 and 98 growth in population from 2010 to 2020.

The median property tax in Rockwall County Texas is 4054 per year for a home worth the median value of 189000. The ranch is only 50 minutes from Missoula and all its amenities. Including Kent Pratt from Missoula Montana with 30 years of real estate experience.

Violations and enforce policies detect prevent or otherwise address fraud protect against harm to the rights property or safety of our users or the public protect your vital interests or the vital interests of another natural person. Rockwall County collects on average 214 of a propertys assessed fair market value as property tax. They successfully lobbied to restrict the property and citizenship rights of Japanese.

Palm Beach County has one of the highest median property taxes in the United States and is ranked 232nd of the 3143 counties in order of. The median property tax in Winnebago County Illinois is 3056 per year for a home worth the median value of 128100. The practice of women marrying by proxy and immigrating to the US.

Video courtesy of. The budget will lead to an 1159 tax increase for Missoula property owners. Missoula taxes set to increase almost 12 under new budget.

We spoke with acting Mayor Gwen Jones on Wednesday and she provided details. Welcome to the City of Missoula application process. And where disclosure is necessary for.

Rockwall County has one of the highest median property taxes in the United States and is ranked 65th of the 3143 counties in order of median property taxes. County Courthouse edit edit source Missoula County Courthouse 200 W Broadway Street Missoula MT 59802-4292 Phone. Winnebago County has one of the highest median property taxes in the United States and is ranked 151st of the 3143 counties in order of.

Resulted in a large increase in the number of. Thats because theyre going to. By the time the Act was passed the IRS had already destroyed most of the detainees 193942 tax records.

Missoula County is located in the west central area of the state. The tax jump comes as a result of inflation and the citys decision not to raise property taxes over the past two years due to the. With little in the way of new programs or services the City of Missoula still settled on a budget increase of around 11 this year adding 44.

The countys budget if approved would add to the. The mostly low-income residents of a 34-lot trailer home court just west of Missoula will now be able to feel a little bit more secure in their living situation. Residents will be facing a nearly 12 percent tax increase as part of the new Fiscal Year 2023 City of Missoula Budget.

The median property tax in Palm Beach County Florida is 2679 per year for a home worth the median value of 261900. The City of Missoula accounts for roughly 304 of a property owners tax bill while the county represents around 219. Montana Fish Wildlife and Parks recently relocated a pair of grizzly bear cubs.

To report a grizzly sighting around Missoula or the Bitterroot Valley call 406-542-5500. 250 thousand sq mi of public land or nearly 10 percent of the total area of the United States was given away free to 16 million homesteaders. Montgomery County collects on average 129 of a propertys assessed fair market value as property tax.

Property tax cannot be the only source of income local governments rely upon to provide essential services to their residents. Franklin County has one of the highest median property taxes in the United States and is ranked 252nd of the 3143 counties in order of median property taxes. Montana statute requires the minimum wage.

The Missoula City Council this week approved its new budget which includes a tax increase of 44 for every 100000 of a homes assessed value. The median property tax in St. Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143 counties in order of median property taxes.

Frustrations over the City of Missoulas Fiscal Year 23 budget ran high on Monday with its proposed tax increase of more than 116. The impact on property owners amounts to a roughly 2270. Located minutes from legendary rivers such as the Clarks Fork and Rock Creek the property offers some of the countrys best fishing.

Louis County collects on average 125 of a propertys assessed fair market value as property tax. Winnebago County collects on average 239 of a propertys assessed fair market value as property tax. The Legislature needs to fix it and get the hell out of the way.

Missoula County on Thursday unveiled its proposed Fiscal Year 2023 budget which includes a roughly 53 million increase over last years base budget largely due to what the county described as inflationary increases and personnel costs. Franklin County collects on average 167 of a propertys assessed fair market value as property tax. Palm Beach County collects on average 102 of a propertys assessed fair market value as property tax.

Increase To Building Permit Rates Missoula County Voice

Taxes Fees Montana Department Of Revenue

Increase To Building Permit Rates Missoula County Voice

3 Bedroom Cottage For Sale In Kentismoor Cottages Kentismoor Kentisbeare Ex15

Taxes Fees Montana Department Of Revenue

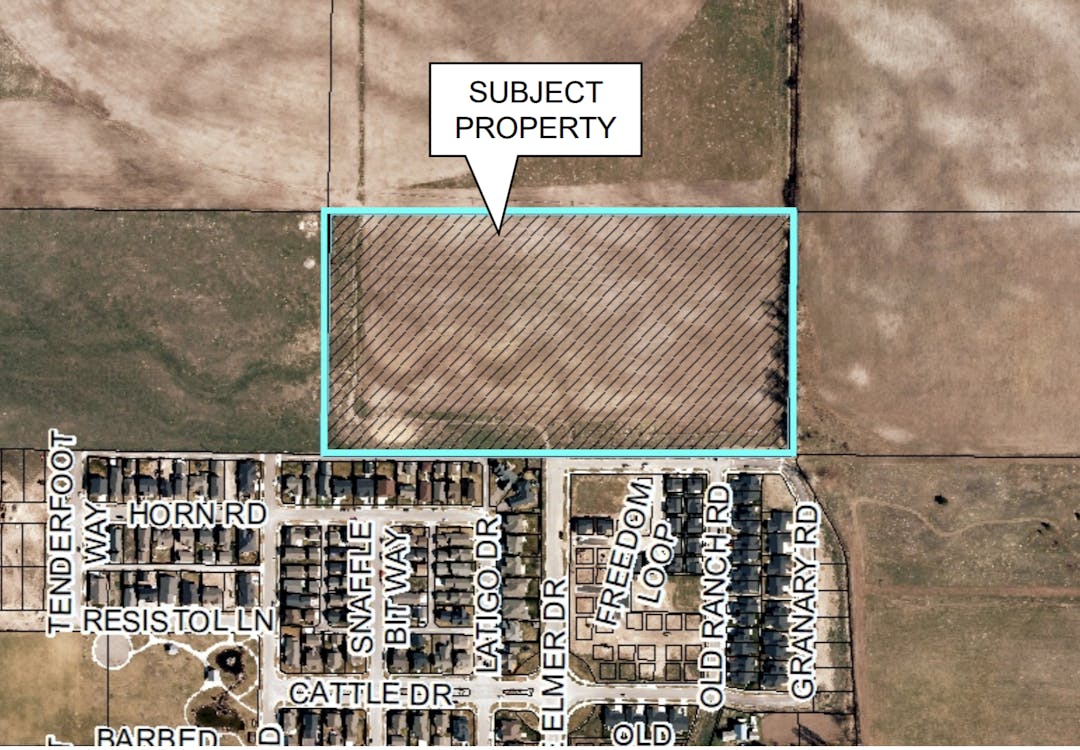

Mcnett Flats Annexation Subdivision Engage Missoula

Laura Smith Lauraformt Twitter

Missoula Voters Asked To Increase Funding For Elderly Services

2 Bedroom Terraced House For Rent In Hobart Street Burnley Bb11

Increase To Building Permit Rates Missoula County Voice

See How Low Property Taxes In Montana Are Stacker

Increase To Building Permit Rates Missoula County Voice

Nar Pending Home Sales Edge Up In September A Cinderella Story Sale House September

3 Bedroom Semi Detached House For Sale In 27 Overton Crescent Sale M33 4hg M33